Across the country, steelworkers at nine plants of Allegheny Technologies, Inc. have been on strike for the last 11 weeks.

They want raises; to stop contracting out; to secure full funding of their retirement benefits; and to beat back management’s efforts to introduce health insurance premiums and a second tier of coverage for younger workers.

The Steelworkers union (USW) accuses ATI of unfair labor practices including bad faith bargaining, and of holding retiree benefits hostage for contract concessions.

ATI, which is headquartered in Pittsburgh, makes steel used in aerospace and defense, oil and gas, chemical processes, and electrical energy generation.

Five years ago ATI locked workers out for seven months, demanding major concessions on wages, pensions, and health insurance. Workers fought off the bulk of those demands, though the company was able to shed future liability for the pension by replacing it with a 401(k) for anyone hired after 2015—a huge cost shift to workers that makes a decent retirement at age 65 unlikely for new hires.

There were 2,200 workers at 12 unionized sites back then. There are 1,300 at nine sites this time around.

Most of the shops are in areas still reeling from the deindustrialization of the ’80s and ’90s. Five are in western Pennsylvania: Canton Township, Brackenridge, Latrobe, Natrona Heights, and Vandergrift. The others are in Louisville, Ohio; Lockport, New York; East Hartford, Connecticut; and New Bedford, Massachusetts, where 60 members are on strike.

MANUFACTURING DESCENT

One of only a few remaining union manufacturers in southeast Massachusetts, ATI has long been seen as a place to earn decent pay and a respectable retirement.

As a young organizer with the United Electrical Workers (UE) in the ’80s and early ’90s I spent many mornings and afternoons leafleting at the ATI plant in New Bedford—then called Rodney Metals, before it was eventually bought out by ATI—and other shops in the area, encouraging workers to organize. (I like to think we helped lay the groundwork for the USW’s eventual success in the mid-’90s.)

Back then there were thousands and thousands of decently paid union workers in manufacturing, and those union shops drove the area rates and standards. The spillover effect was real. Non-union employers like Rodney Metals were “forced” to pay similar rates and conditions in order to compete for workers.

Those days are gone. Like many places throughout the country, southeast Massachusetts lost thousands of manufacturing jobs—union and nonunion—during the Reagan era of greed, union-busting, and moving jobs to lower-wage, nonunion locations (sometimes overseas, but not always). UE lost close to 2,000 members in southeast Massachusetts in less than a decade.

Some of the more innovative and militant strategies to fight plant closings were developed from the struggles of these workers to defend and preserve manufacturing jobs in hard-hit industrial New England.

Now, with the pension replaced by a 401(k) and after seven years of wage freezes, working at ATI—or in manufacturing generally—is not such a great deal anymore. Factory work in the area is now pretty much all nonunion, and most places pay less and provide fewer benefits than they did 20 years ago.

Plus, anyone who has worked in a factory knows the toll the work takes on your body and soul. The camaraderie can be great, but the brutal pace of work in an unhealthy environment is unrelenting. Your body slowly unravels and falls apart.

FLUSH WITH CASH

Now ATI is demanding to gut the benefits of present and future workers even further, which will further erode the living standards of the area. To sell its offers, the company points to wage increases and lump sum payments—but, as the union has pointed out, these are all based on savings generated from other concessionary proposals.

Meanwhile, the company has almost “a billion dollars in liquidity and more than half a billion dollars in the cash drawer,” according to a strike bulletin from the union. The three top executives made $22 million last year in salaries and an additional $17 million in bonuses.

The average hourly rate for production workers is only in the mid-$20s per hour, with the lowest-paying job around $22. Lots of maintenance work has been subcontracted, especially since the last contract. Presently to contract out work the company simply has to notify the union and engage in a discussion; if it doesn’t, the company pays a penalty to a local charity.

These “notification” requirements have done little to stop the company from decimating the maintenance department. But even this weak arrangement isn’t enough for ATI. It wants no accountability or discussion with the union about keeping maintenance work in-house, and it continues to propose eliminating arbitration over even the minimal requirement to give notice.

A PREMIUM ON HEALTH INSURANCE

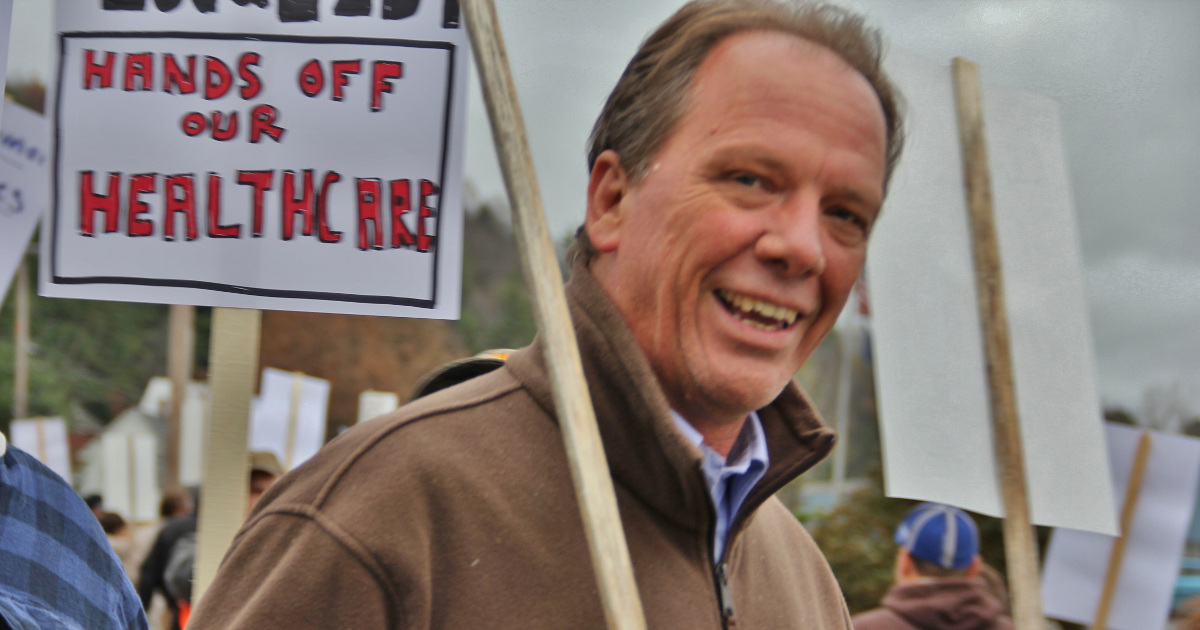

This strike is in large measure over health insurance. In a sea of non-union workplaces with unaffordable health plans, ATI workers are striking to keep their plan affordable to members.

Presently the company pays the entire health insurance premium—workers were able to stave off ATI’s efforts to force them to pay premiums during the 2015-16 lockout. Workers have an upfront deductible that is 10 percent of first-dollar coverage up to $300 for an individual and $600 for a family per year. If you go outside the network, it is double those figures.

ATI now wants workers to pay 5 percent of the premium and increase the deductible to $500 for an individual and $1,000 for a family. What the company is really after, however, are the new hires: the company wants them to pay 10 percent of their premiums. It’s the typical and divisive two-tier system that unions know all too well.

The Kaiser Family Foundation, which researches and publishes national health insurance data and conducts annual surveys on employer-provided health insurance, says that in 1999 the average annual premium was $2,196 for single plans and $5,791 for family plans. Twenty years later those figures have skyrocketed by 240 percent and 269 percent, respectively, to $7,470 for individuals and $21,342 for families.

Employers still contribute the majority of that, but workers now pay an average of $5,588 in premiums alone for family coverage (up from $1,543 in 1999), not to mention the increased share of other medical costs they bear. Wages over that same period have increased, on average, only 77 percent.

A BENCHMARK FOR ALL

Up until the 1980s, when the health insurance industry and employers began imposing premiums, deductibles, co-pays, and other schemes to gobble up more of our paychecks, fully employer-paid health insurance was not uncommon at all.

Those union workplaces that have been able to maintain that standard help all of us—not just their members. They set a benchmark for the wages and benefits that other employers in the same industry or geographic area need to provide to stay “competitive.” They influence what workers and the local community expect a job to offer.

When a benefit is allowed to erode over time, so does the standard. Seeing these workers at ATI fighting to defend premium-free health insurance, something most unions have lost, is inspiring.

“I am proud of my fellow brothers and sisters on the line,” said Bedford ATI worker John Camarao, the grievance chair for USW Local 1357. “Members are in a great hardship right now entering the third month of the strike, but what we’re fighting for is not only for our future but for the future of new hires and our retirees’ benefits.

“Their demands are meant to divide us, but instead they have united us, and our resolve is to see this to the end.”

This blog originally appeared at LaborNotes on June 14, 2021. Reprinted with permission.

About the Author: Peter Knowlton is the retired general president of the United Electrical Workers (UE).